Indiana Tops in Midwest For Tax Climate

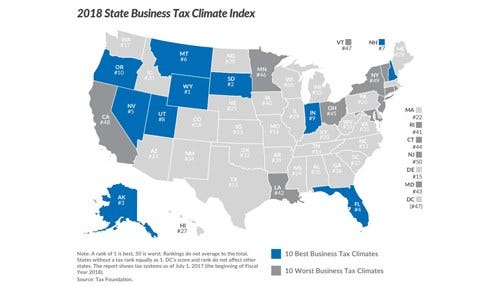

(image courtesy the Tax Foundation)

(image courtesy the Tax Foundation)

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana continues to have one of the most competitive tax codes in the nation, according to an annual study. The Tax Foundation’s 2018 State Business Tax Climate Index ranks Indiana 9th for its overall tax climate, and tops in the Midwest.

The Tax Foundation says the index is designed to show how well states structure their tax systems and provide suggestions for improvement. The rankings are determined by evaluating variables in five tax categories: corporate, individual income, sales, property, and unemployment insurance.

Scott Drenkard, director of state projects for the Tax Foundation, said Indiana’s tax reform is "groundbreaking and reflects a thoughtful, mature approach to building a simple, competitive tax system."

Indiana is the only Midwestern state in the top 10. Oregon is ranked 10th on the list, while Utah narrowly beat the Hoosier state for 8th place.

"Indiana saw consistent rate reductions through a series of responsible tax reform efforts between 2011 and 2016," the index said. "Subsequent legislation established a further schedule of corporate income tax reductions through fiscal year 2022. For 2018, the corporate income tax rate declined from 6.25 to 6.0 percent. These changes, however, were not enough to improve Indiana’s already enviable ranking on the Index, where the Hoosier State and Utah are functionally tied for the best rankings among states which impose all the major taxes."

Wyoming tops the list for 2018, followed by South Dakota, Alaska, Florida and Nevada. You can connect to more about the ranking by clicking here or viewing the index below: