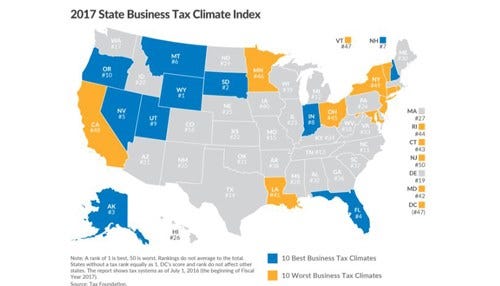

Indiana Ranked Among Best Tax Climates

(image courtesy of The Tax Foundation)

(image courtesy of The Tax Foundation)

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana is ranked in the top 10 for the most competitive tax code in the nation. The Tax Foundation’s State Business Tax Climate Index ranks Indiana 8th for its overall tax climate.

The Tax Foundation says the index aims to show how well-structured each state’s tax code is. The rankings were determined using analyzing tax variables in five different tax categories: corporate, individual income, sales, property and unemployment insurance.

"Our goal with the State Business Tax Climate Index is to start a conversation between taxpayers and policymakers about how their states fare against the rest of the country," said Jared Walczak, policy analyst for the Tax Foundation. "While there are many ways to show how much a state collects in taxes, the Index is designed to show how well states structure their tax systems, and to provide a roadmap for improvement."

Indiana ranked 23rd for corporate tax structure, 11th for individual income tax structure, 10th for sales tax structure, 4th for property tax structure and 10th for unemployment insurance tax structure.

Wyoming, South Dakota and Alaska topped the list with the most competitive overall tax climate. New Jersey, New York and California were listed as the states with the least competitive tax climate.

You can connect to the full report by clicking here.