Nextremity Touts Success With New Strategy

The InCore Lapidus System

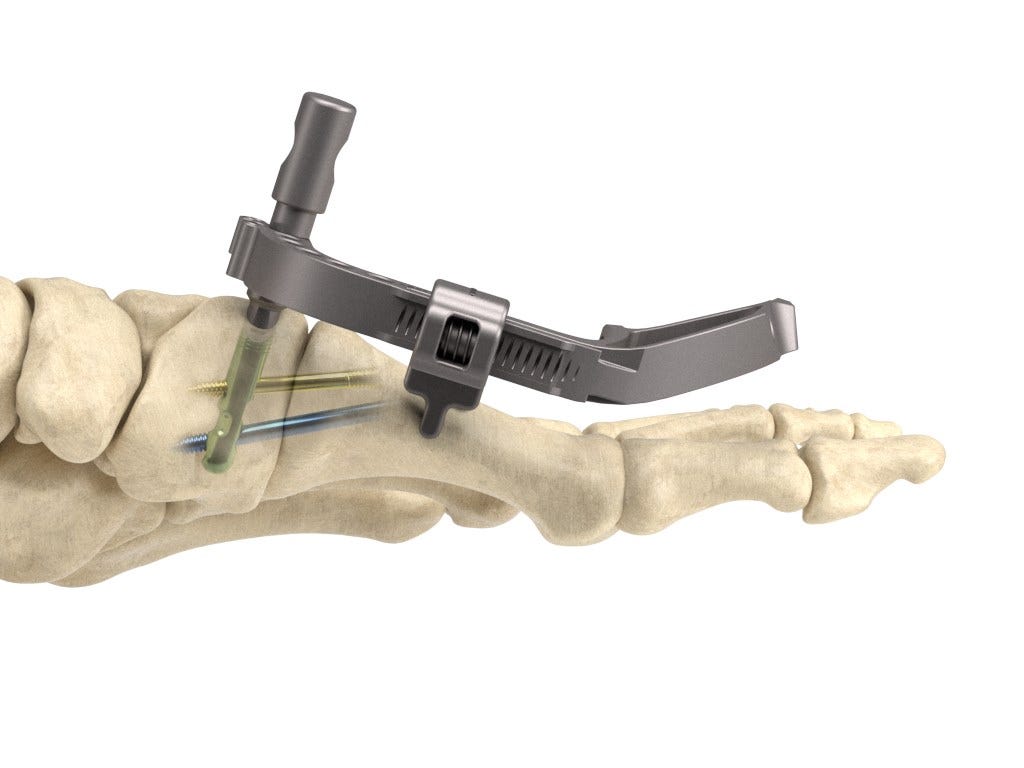

The InCore Lapidus System

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowWarsaw-based Nextremity Solutions, Inc. says 2018 was a critical year of validation. The orthopedic company changed its business model in 2016—moving away from its roots as a traditional startup and becoming a strategic commercialization organization. Nextremity leaders say the shift was a success; the company recently ranked 331st on Deloitte’s Technology Fast 500 with a 246 percent revenue growth rate.

While taking leaps forward, Nextremity executives say the company’s strategy still centers on its visionaries: orthopedic surgeons. Dr. Lon Weiner and Dr. Stuart Katchis—both in New York City—co-founded the startup in 2007 by identifying unmet needs in the operating room. Nextremity Chief Technology Officer Ryan Schlotterback says the team took the surgeons’ East Coast ideas and brought them to the fertile soil of the Orthopedic Capital of the World in 2013.

“There’s huge value [being in Warsaw],” says Schlotterback. “Since 2016, our strategy is to develop products and deliver those to the large strategic OEMs. And here in Warsaw, there are some of the biggest; it works really well to be local and close to them.”

Nextremity specializes in foot and ankle implants, which are among the fastest-growing areas in orthopedics. When the young company shifted its business model in 2016, Schlotterback says it desired something different than a traditional product development or fee-for-service company.

“So we landed somewhere in the middle,” says Schlotterback. “Today, we’re a strategic commercialization organization where we develop products and take them to the market, with all of the traditional marketing collaterals and sales tools. We prove those products out, then we turn those over to one of the large strategic companies to take it more fully into the market and around the globe.”

Nextremity leaders say the shift—and the successful partnerships that have come along with it—opened the door to the exponential growth that landed the company on Deloitte’s Technology Fast 500. Product launches in 2018, such as the InCore Lapidus System, an orthopedic device for the foot, also contributed to sales momentum.

“[Our products] are very different than what’s on the market. We’re focused on developing products that allow the surgeon to have reproduceable outcomes and really stable constructs,” says Schlotterback. “All of our products—whether it’s for hammertoe or bunions—approach those [conditions] from a different angle that’s unlike what else is on the market.”

Nextremity says its i3 Strategic Solutions team executes a process flow called micro-commercialization, which is “the heart of what we’re doing.” Schlotterback says the “more wholistic approach” centers on surgeons, streamlining product development to ensure their ideas are commercialized and, ultimately, help patients.

Nextremity has commercialized seven products; the eighth has earned regulatory clearance and will be launching soon. The company, now with 18 employees, says it has a very strong pipeline and expects to commercialize two or more products this year.

With innovations conceived by surgeons and ultimately used by them, Schlotterback says Nextremity has settled into its sweet spot—filling the gap in the middle.

“Nextremity is best suited to keep delivering value to our shareholders by continuing to develop products and solutions to the market and, ultimately, to our strategic partners,” says Schlotterback. “If we do that, the rest will take care of itself.”

Schlotterback says Nextremity’s partnership with a large orthopedic company opens the door to global markets.

Schlotterback says shifting Nextremity’s business model in 2016 allowed it to focus on what it does best.