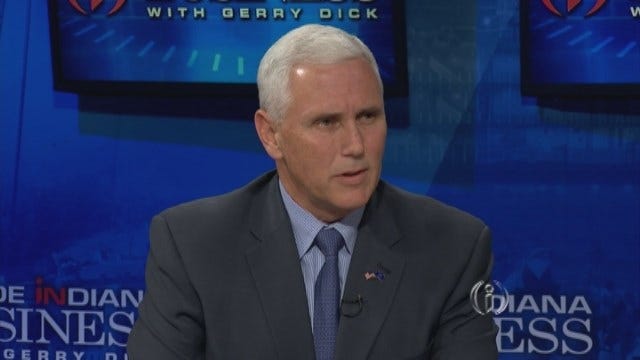

Pence: Early Loan Payoff Good For Business

Pence met with Trump recently in New Jersey.

Pence met with Trump recently in New Jersey.

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowGovernor Mike Pence says the proposal to pay off a Federal Unemployment Insurance Tax loan early will help "significantly decrease" a burden on Indiana employers and taxpayers. During a news conference this morning in Indianapolis, Pence said the $327 million avoided in federal penalties boils down to a savings of $126 for every worker in the state.

The governor said "by advancing funds to the Department of Workforce Development to pay off the outstanding loan to our unemployment trust fund, Indiana is demonstrating the importance of growing and maintaining economic achievement in our state. Removing this tax penalty for employers frees up resources that can be invested in hiring new employees, growing existing companies, raising wages, and more, and I’m confident that by removing this financial impediment to hiring, Hoosiers will continue to see economic opportunity all across our state."

The $250 million in funding will come from state reserves. The move was applauded by several of the state’s top lawmakers, as well as the Indiana Chamber of Commerce, which says "several hundred" Hoosier businesses have reached out to the organization to express their support.

The advance from state coffers will be paid back over the next eight months from regularly-collected unemployment insurance fees from businesses.