Indiana Life Sciences VC Funding Banks Highest Year Ever

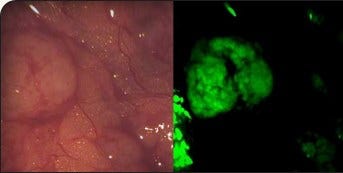

On Target Laboratories raised the most VC money in 2017; its technology illuminates cancer cells during surgery.

On Target Laboratories raised the most VC money in 2017; its technology illuminates cancer cells during surgery.

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowVenture capital funding in Indiana’s life sciences sector, including health information technology, hit an all-time high in 2017 at $107 million; it marks the second time in the last four years the total surpassed the $100 million mark. Hoosier life sciences leaders say the total is also remarkable because it’s “lightyears” better than years past; it was only $80 million for the entire decade from 1993 to 2002. The state’s life sciences initiative BioCrossroads is hopeful $100 million worth of momentum will drive big amounts in 2018.

“[$107 million] is a good number and bigger than what people expect [in Indiana],” says BioCrossroads Project Director Brian Stemme. “We hope for even more next year, but understand that raising VC money is never linear, it’s going to be lumpy.”

Previous tallies are $89 million in 2016, $49 million in 2015 and $105 million in 2014. Stemme says a key factor in the VC dollar amount each year is what stage of the product lifecycle Indiana’s young companies are in. In 2017, the top two investments were West Lafayette-based On Target Laboratories and Indianapolis-based Outpost Medicine, which are both in the clinical testing phase, “always the most expensive part of the entire process,” says Stemme.

On Target led the pack last year, raising $40 million from Johnson & Johnson’s venture capital arm, JJDC Inc. The startup is in Phase 3 clinical trials for its technology that illuminates cancer cells during surgery, so doctors can see exactly where the disease is and remove it more easily. Outpost Medicine raised $20 million last year and is entering Phase 1 clinical trials for its potential drug to treat urologic and gastrointestinal disorders.

Wellfount, WishBone Medical and Apexian Pharmaceuticals rounded out the top five investments in 2017. There was a substantial amount of larger investments last year; the top 10 ranged from $2 million to $40 million.

Stemme notes the number of companies receiving investment is also significant; 33 companies received 35 investments last year. He likens the growing number to the Hoosier pastime of basketball.

“VC investing is a lot like the number of shots on goal. If you keep shooting, eventually, the more you’ll score,” says Stemme. “The more companies that are getting invested in, the more likely that one of those is going to be successful. And the companies that are raising $500,000 now are the $10 million companies of the future.”

Despite 2017’s success, fundraising in Indiana is not without challenges. Stemme notes seed funding can be the hardest money to come by for early-stage startups, but is critical for them to advance.

“That zero-to-$1 million mark is the area where we’re still trying to get better,” says Stemme. “BioCrossroads has a seed fund, there’s also VisionTech Partners, Elevate Ventures, the universities’ seed funds and a few other seed funders, but we need more, because that’s the hardest money to raise.”

BioCrossroads also works to create an overall climate in Indiana that will breed success for life sciences discoveries. In addition to investing, BioCrossroads aims to help startups connect with quality scientists and board members, collaborate with larger companies and accelerate research.

“[Indiana] has made progress both in the amount of companies that are raising money and the size of the rounds,” says Stemme. “The road for life sciences companies to commercialize their products is long, risky and capital intensive. Each company will require novel science, strong leadership and tens or hundreds of millions in funding from investors—before a product is even launched. But with recent successes such as Assembly Biosciences, Orthopediatrics and Marcadia Biotech, Indiana has proven that it can attract venture capital and reward investors.”

Stemme says life sciences VC funding in Indiana is strong compared to similar states.

Stemme says local VC is a priority, but startups will often need to find money outside of Indiana.